Здравейте or in English…HELLO!!! 2nd cup of coffee for me but today, let’s address some key questions that probably occupy the minds of many crypto holders: What has caused this vicious crash we had to endure? In the short-term, has enough damage been done already or the worst haven’t come yet? In my opinion long-term vision hasn’t changed. Free people from the overreach and manipulation of governments and central banks and create a more equal, free financial system.

Today’s ‘‘Carte Du Jour’’:

⏳ Estimated reading time: 5 minutes & 58 seconds

🥐 FRENCH CROISSANT: Cryptocurrencies & large institutions

🍕 PEPPERONI PIZZA: Yummy, but proceed with caution

🍭 LOLLIPOP

CRYPTOCURRENCIES & LARGE INSTITUTIONS

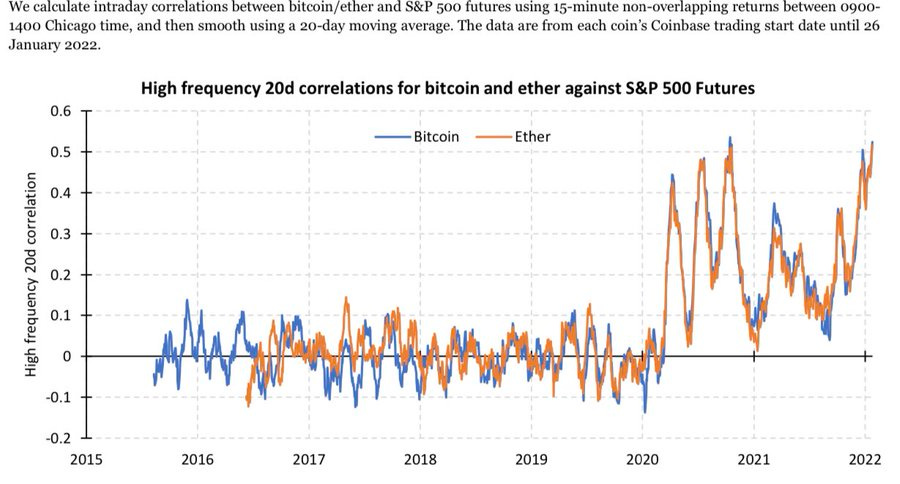

1) Crypto has in no way been uncorrelated from stocks and other risk assets. In fact, it has practically performed like leveraged tech stocks (see chart below):

2) Bitcoin has failed to act as an inflation hedge, and with an over 70 % price decline, its “store of value” and “digital gold” narrative has taken a serious blow.

3) While crypto has been hit hard, it doesn’t have to take all the blame: Equities – especially tech stocks – had to take an equally ‘‘large haircut’’.

You might ask yourself, what has caused this sudden crash? Was it the death of Terra? The collapse of an UnSTable coin (UST)? Yes, that definitely tricked a lot of investors and deceived large institutions and companies. I also believe that the next algostable coin, would have difficulty ever achieving a similar adoption scale.

Furthermore, are there more reasons connected to this ‘‘crash’’;

○ First of all we find ourselves in the middle of a macro storm that has sent all risk assets crashing down. With crypto being an asset class still in development or in early stages, it never had to go through a major global recession apart from when covid hit everyone…

○ We had everyone cheering back in 2020 when institutional crypto adoption arrived in our shores! A large group of traditional investors now comes back to roost because crypto being perceived as the riskiest asset class, BTC and ETH are the first assets to be liquidated from institutional books. And for the past month or so, funds have to sell other assets to cover margin calls and reduce their portfolio risk. This self-perpetuating mechanism has led to the relentless selling.

○ Following on our previous note…here comes huge leverage and bad risk management. Without the massive build-up of leverage through the last bull market, we would likely have seen more gradual price declines. No no no, this time, it’s not only leveraged traders on Bybit and other leveraged exchanges who caused the crash. We witnessed massive liquidations from VCs and crypto funds respectively. We covered some of those on my previous article if you want to have a look. It’s like a domino party and sadly, this fear and uncertainty has spread throughout the whole crypto ecosystem.

YUMMY, BUT PROCEED WITH CAUTION

Capital preservation is more important than aiming for big gains. While no one can trade perfectly around market cycles and time bottoms and tops, the drastically shifting market environment has forced every crypto investor and trader to rethink his or her strategy. Don’t get me wrong, it’s not always a ‘‘bad thing’’ when we are down but always proceed with caution ladies and gents!

In a bear market as we find ourselves in today, “selling rips” and buying big red candles is the way to go. No this is not financial advise😉. This simply means every bounce should be regarded as an opportunity to assess one’s holdings and possibly derisks. While cash is king, this doesn’t mean that you shouldn't take advantage of attractive prices offered by crashes as we witnessed on 18th of June. If you still believe in the long-term prospects of crypto, then such massive price drops should be viewed as a unique buying opportunity to either add to your long-term holdings and lower your cost basis or to take advantage of short-term swing trading opportunities. For some people, that could finally be their lucky break or simply a golden opportunity…

TOP 6 CRYPTO NEWS 🗓️

1. BTC sees its biggest quarterly drop in over a decade while tech stocks take a dive as well. 🥶

2. Voyager Digital is the latest crypto platform to pause withdrawals for users as FTX’s CEO warns that many exchanges are secretly insolvent. 🥶

3. The SEC rejects Bitcoin ETF. Grayscale sues crypto’s most infamous regulator after it rejects its request to convert its establish Bitcoin Trust into a spot Bitcoin ETF. 👺

4. After a one month delay, Cardano developers initiate the test net for one of Cardano’s biggest upgrades to date. 🥱

5. Atom’s CEO steps down after core developers confirmed that interchain security is coming soon. 👺

6. The EU passes the latest version of MiCA bill which will see stablecoin use limited and cryptocurrencies delisted, with personal crypto wallets to be tracked. 😤

TOP 6 LATEST ARTICLES 💣

Meta Launches Meta Pay, a Metaverse Dedicated Digital Wallet 🧨

Core Scientific Sold Over 7K Bitcoins for About $167M in June 🎏

Bitcoin faces fresh pressure as US dollar crushes gold, risk assets 🌡️

Crypto investor Sequoia Capital China reportedly raises $9 billion 🐉

Circle's USDC on track to topple Tether USDT as the top stablecoin in 2022 🔍

Side note (as always): If you feel something should be added/removed/changed let me know. Feedback is very much appreciated.

Disclaimer:

― I am not anyhow related to, paid by, or involved with development in any of the mentioned projects or protocols. All the information mentioned above, is merely MY OPINION, based on my research.

― In any case, THIS IS NOT FINANCIAL ADVICE, it is written for educational purposes ONLY.